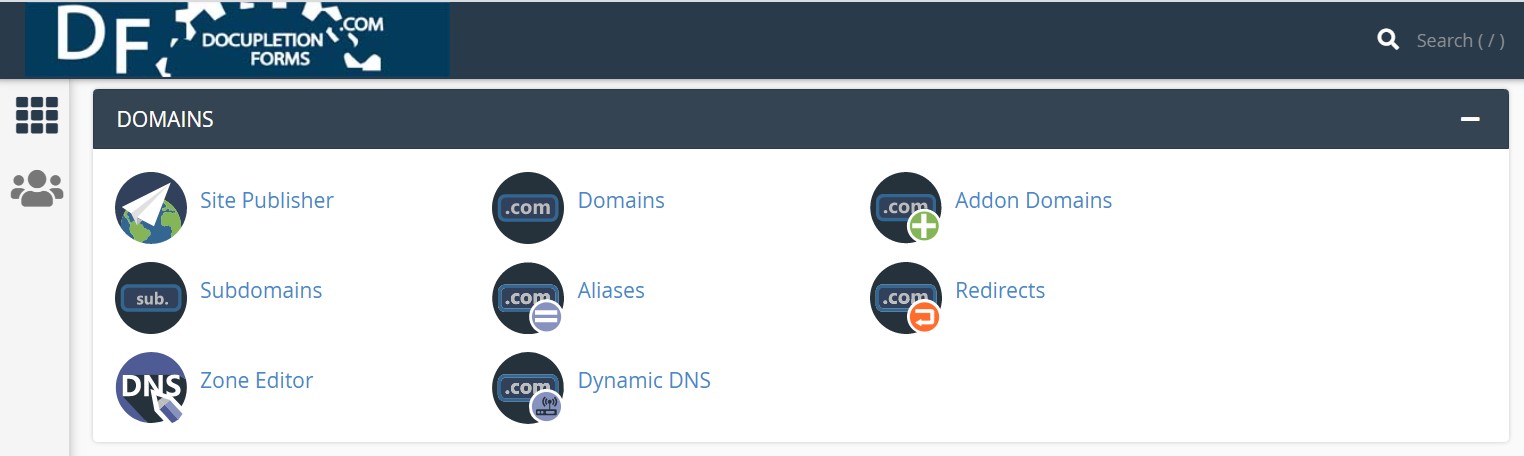

Our 50GB Hosting is 50GB on your own cPanel, and therefore we think you might find the cPanel Blog interesting. cPanel is something we initially offered simply so that you could host your own HTML files inside of the File Manager, but there are so many other things you can do with cPanel. Checkout the cPanel Blog, and also, checkout our 50GB WordPress hosting on your own cPanel for $20/mo.

As always, if you want to learn more about WordPress Security, Checkout our growing list of videos you can access for FREE! We purchased a license from a professional group to use their videos on WordPress Security on our site and the license requires us to charge money, so we set the price low at $1.

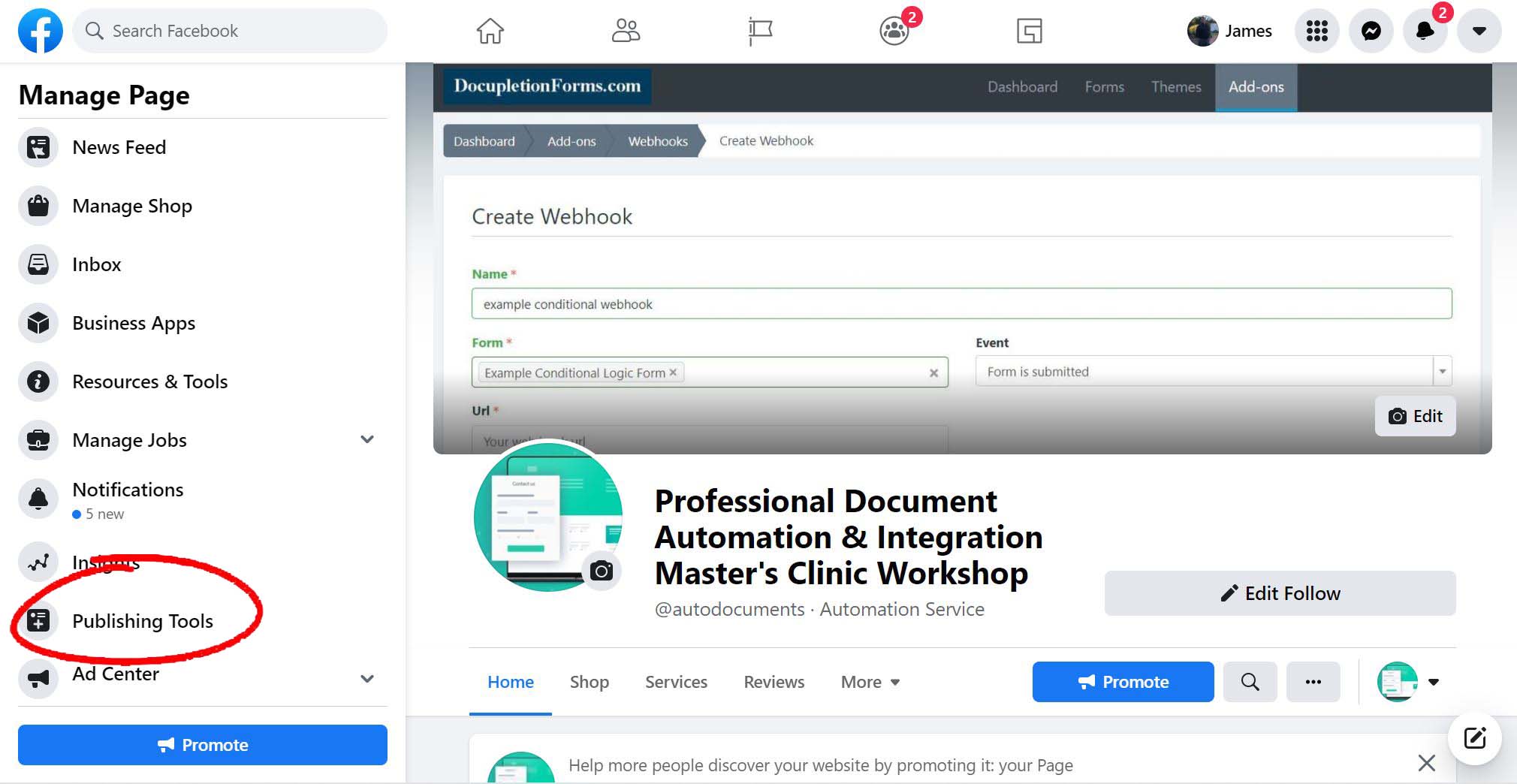

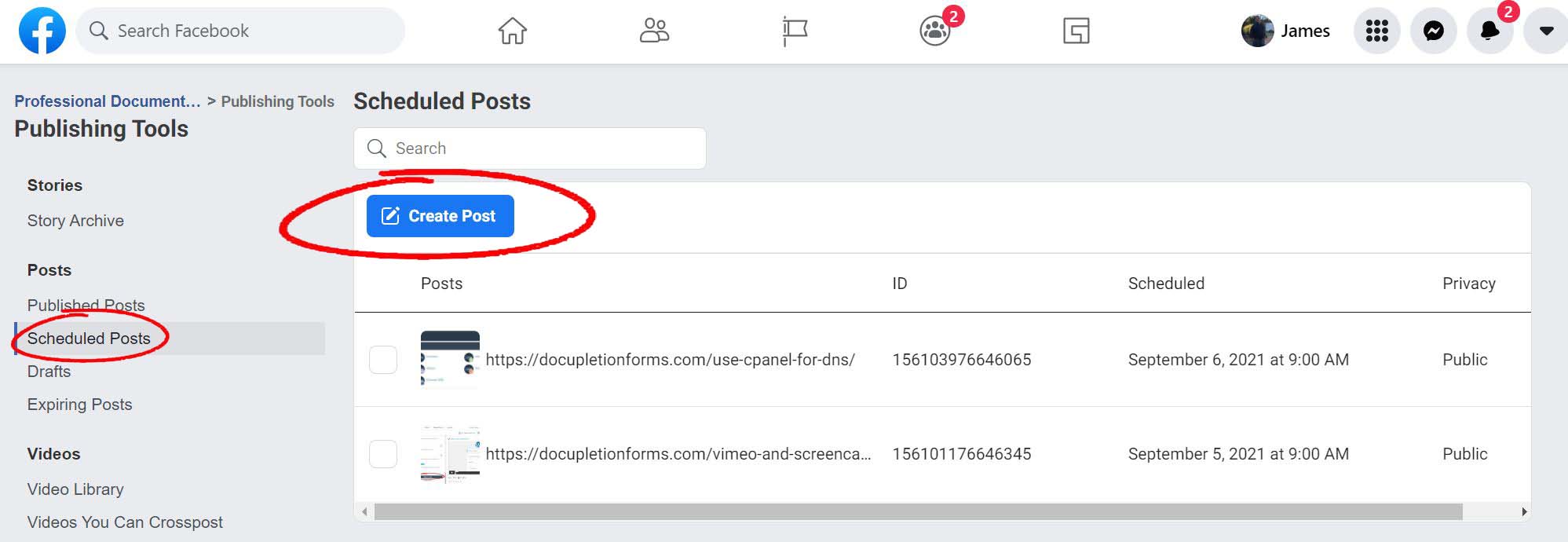

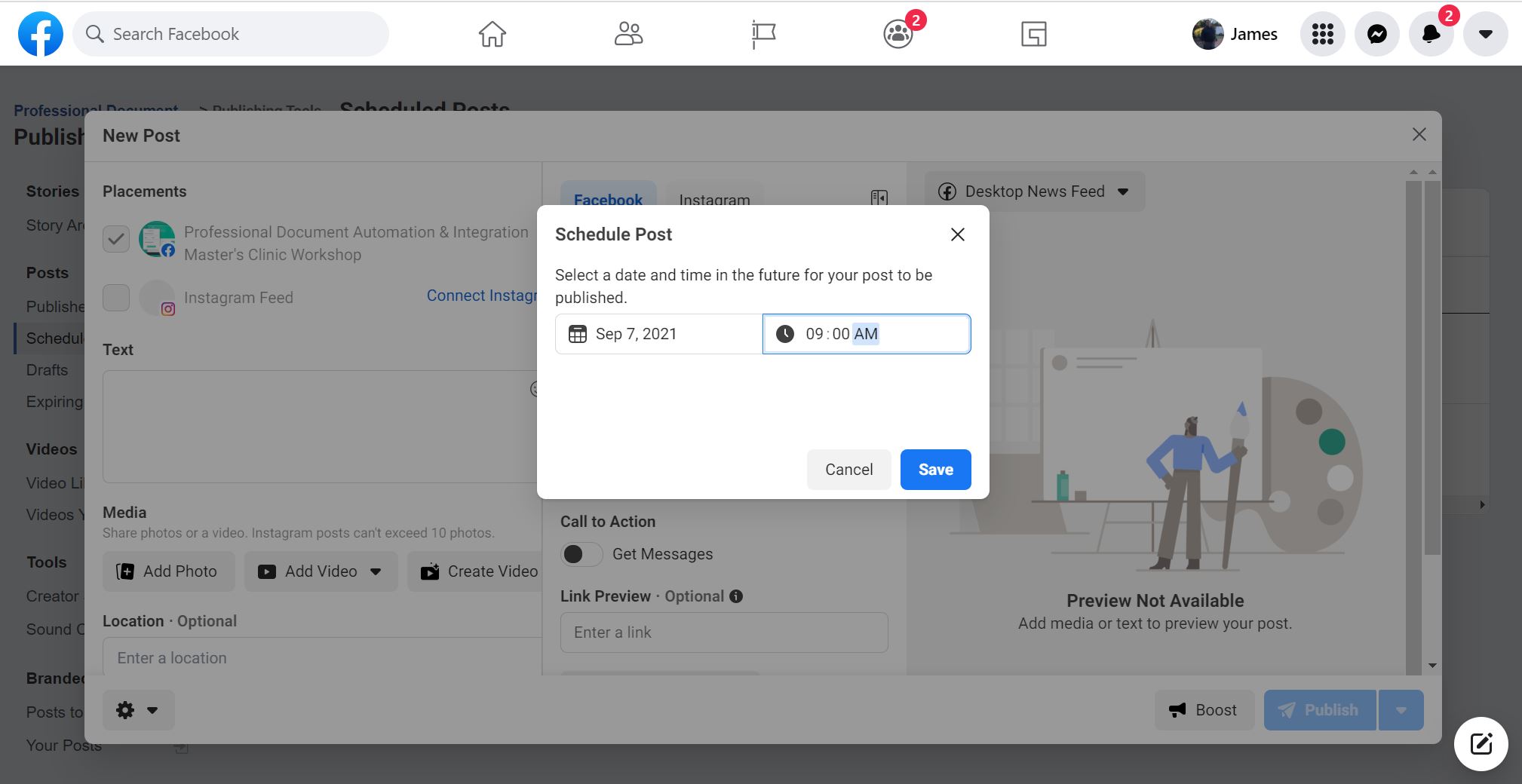

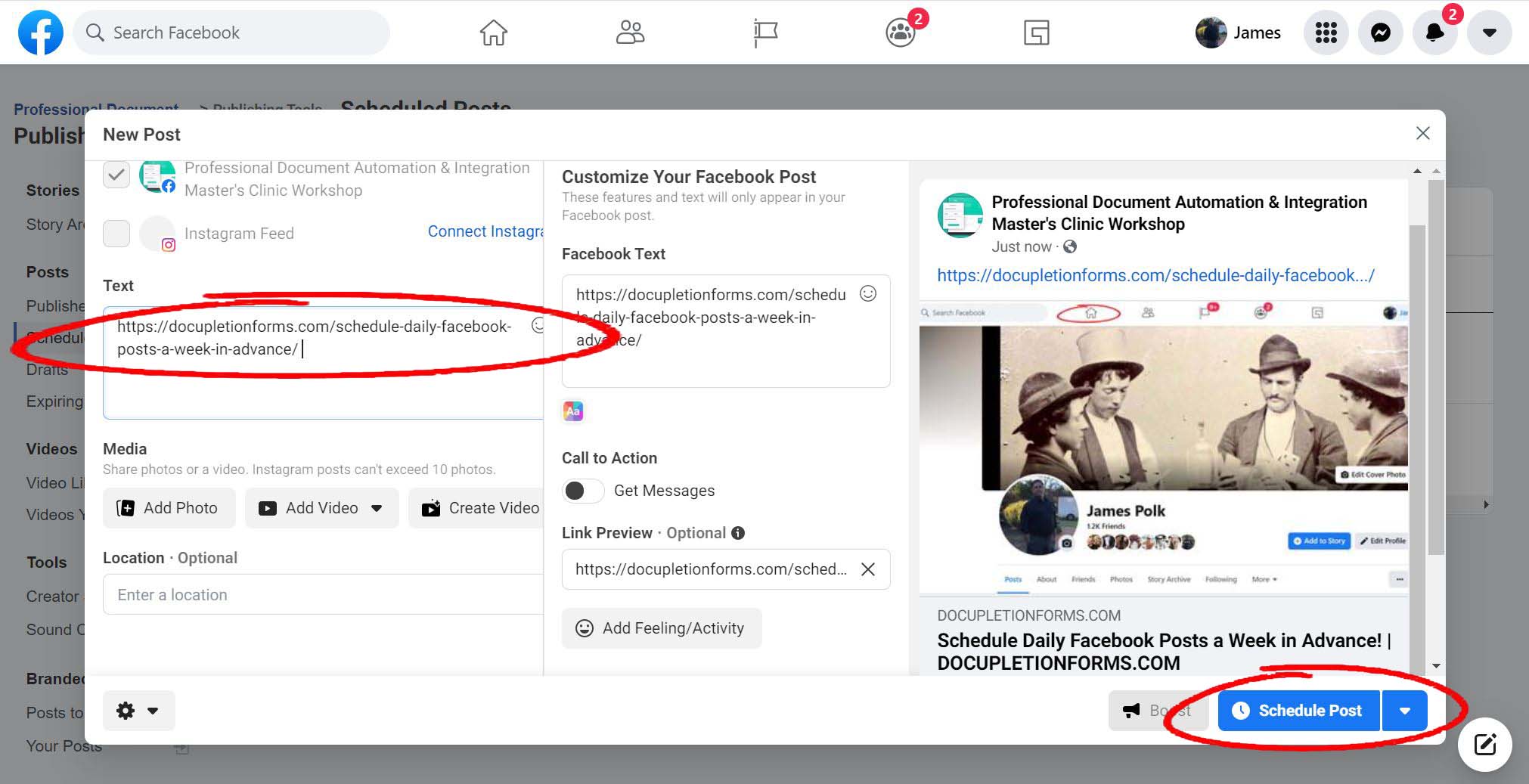

Make sure to take a look at our new Training Facebook Page: “Professional Document Automation & Integration Master’s Clinic Workshop” where we post daily content aimed at helping you as a Legal Document Related Industry Professional.

And of course we still have our Main Facebook Page.